NFTY Finance Composability: Building blocks for NFT Finance

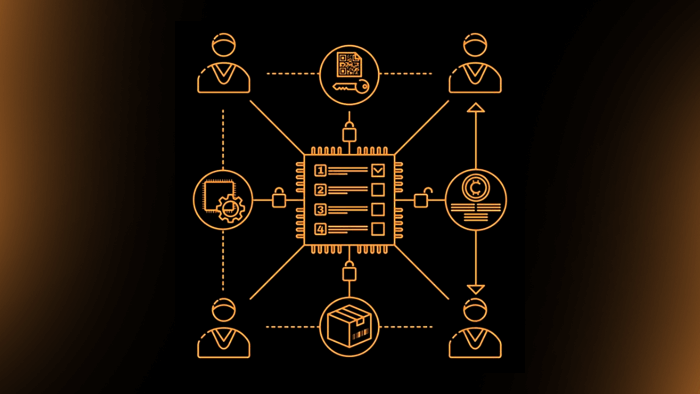

Composability has emerged as a key concept in the decentralized finance (DeFi) space, enabling developers to combine existing smart contract components to create new and powerful applications.

NFTY Finance, a decentralized lending protocol for NFTs, has embraced the principles of composability, allowing projects to leverage its features and build on top of its infrastructure. By doing so, NFTY Finance aims to foster a collaborative ecosystem that promotes innovation, efficiency, and customization in the world of decentralized NFT lending.

What is Composability?

Composability is essentially the ability to combine distinct components to create new systems or outputs, similar to how Lego blocks can be assembled to build complex structures.

In the context of Ethereum and smart contracts, composability means that developers can reuse existing software components to build new applications without reinventing the wheel or starting from scratch. This approach significantly shortens the development cycle and encourages greater innovation by providing developers with a rich pool of building blocks to work with.

Key features for composability

NFTY Finance has introduced several key features that make it highly composable for projects looking to build on top of its protocol. Let's explore these features and their potential for driving innovation within the decentralized lending ecosystem:

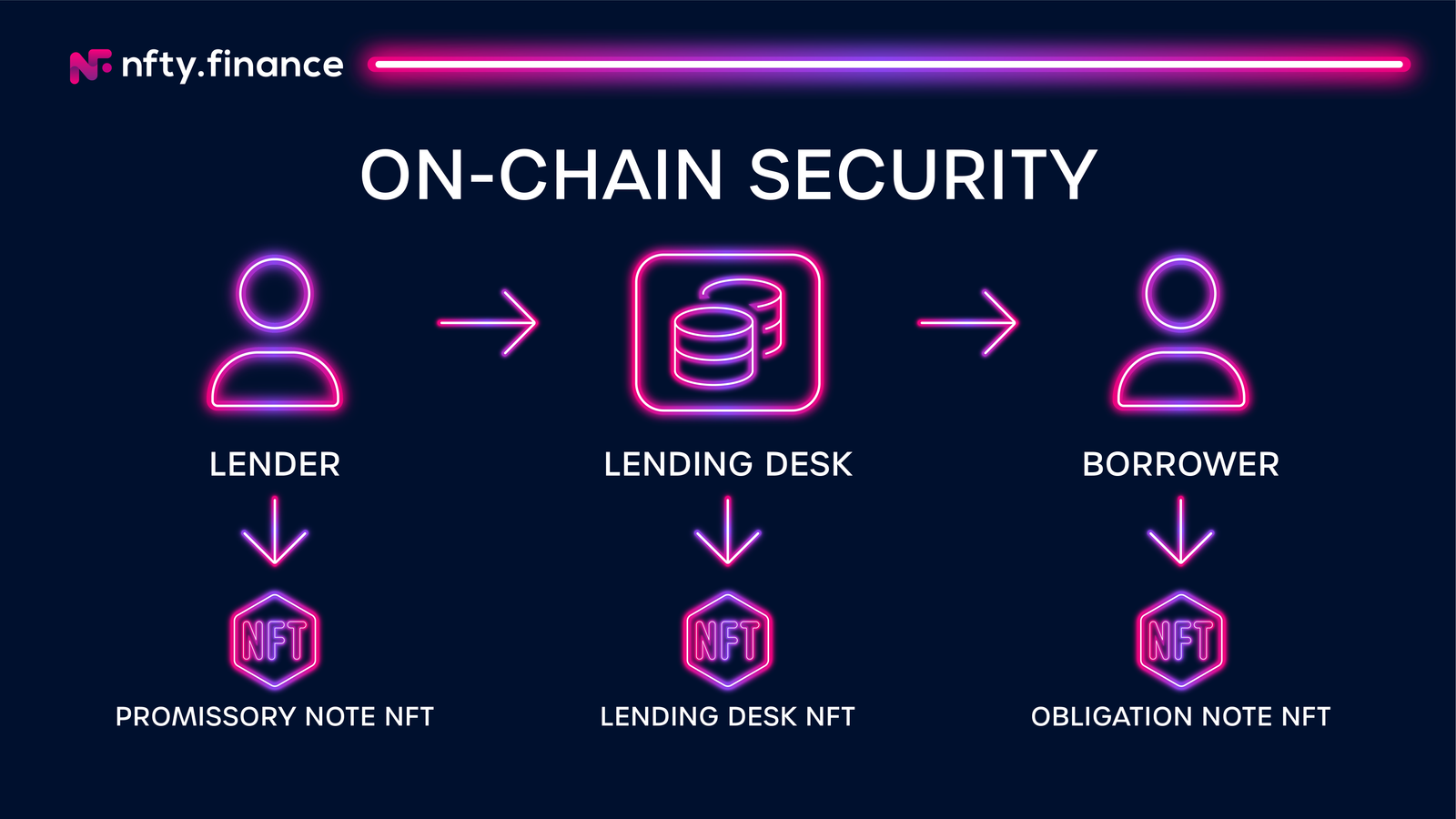

- Lending Keys: At the center of the NFTY Finance protocol design is the "Lending Desk". Ownership of this lending desk is represented as an ERC-721 NFT, enabling enhanced flexibility and transferability, while also creating opportunities for developers to build on top of NFTY Finance. By leveraging the "Lending Keys", projects can introduce unique mechanisms and ownership structures to cater to specific user needs.

- NFTY Notes: Loans are also tokenized as ERC-721 NFTs, with the lender issued a "Promissory Note" and the borrower issued an "Obligation Note" at time of loan issuance. Collectively, these NFTs are known as the "NFTY Notes", and they enable seamless tracking and management of loans. Developers can leverage "NFTY Notes" to build sophisticated loan tracking and risk management tools, further enhancing the overall lending experience. Going a step further, developers can build entire derivative ecosystems based off the "NFTY Notes" assets.

- Infinite Collections per Desk: NFTY Finance now supports multiple lending parameters within a single Desk. This flexibility allows projects to introduce a wide range of lending options and customized loan terms to an infinite number of collections, serving various borrower needs. Developers can leverage this feature to create lending platforms specialized for specific niches or asset classes with specific parameters.

- Loan Aggregator Across all Desks: NFTY Finance has implemented a loan aggregator feature that enables borrowers to search and compare loans across all Lending Desks. This tool improves market efficiency and transparency, streamlining the borrowing process. Projects can build on top of this aggregator feature to create comprehensive loan aggregators or automated lending strategies that span multiple desks.

- Lending as AMM Architecture: NFTY Finance has implemented an automated market maker (AMM) architecture for Lending Desks. This ensures consistent liquidity and efficient pricing, creating a seamless borrowing and lending experience for users. Projects can integrate with this AMM architecture to enhance liquidity provisioning or introduce innovative pricing mechanisms tailored to specific assets or user segments.

- Valuation System Without Oracles: NFTY Finance has implemented a valuation system where borrowers and lenders play the central role in determining borrowing and lending offers. Lenders have the freedom to establish their own minimum and maximum offer prices for any collection, while borrowers have access to a wide range of available offers. This approach ensures that borrowing and lending valuations are driven by the market rather than relying on oracles.

Conclusion:

The integration of these composable features within NFTY Finance significantly elevates the platform's functionality, flexibility, and security. By embracing the principles of composability, NFTY Finance is setting new standards for user-centric, transparent, and customizable lending protocols. Developers and projects can leverage these features to build innovative applications, explore new lending models, and contribute to the evolution of decentralized finance.