NFTY Finance: Revolutionizing NFT Lending With an Innovative LAMM Model

NFTY Finance is not just another player in the fast-growing NFT lending space. It brings a whole new approach to the table with its innovative LAMM (Loan Automatic Market Maker) model. This is a model that not only simplifies NFT lending but adds a layer of versatility and customization hitherto unseen in the sector.

The NFTY Finance Approach

With NFTY Finance, a lender creates a 'Lending Desk' that supports automatic loan issuance based on preset conditions. These presets include the NFT collections they want to lend against and the lending parameters for each collection. Parameters such as minimum and maximum interest, loan duration, and loan amount can be set to establish the total value locked (TVL) ratio of the loan.

Once the Lending Desk is set up, the borrower can choose the NFT they want a loan against and pick the best loan option from the aggregator. This aggregator curates the best matches based on the borrower's criteria for duration, interest, and amount. The loan request is then issued automatically against the chosen Lending Desk, fitting within the lender and borrower's criteria.

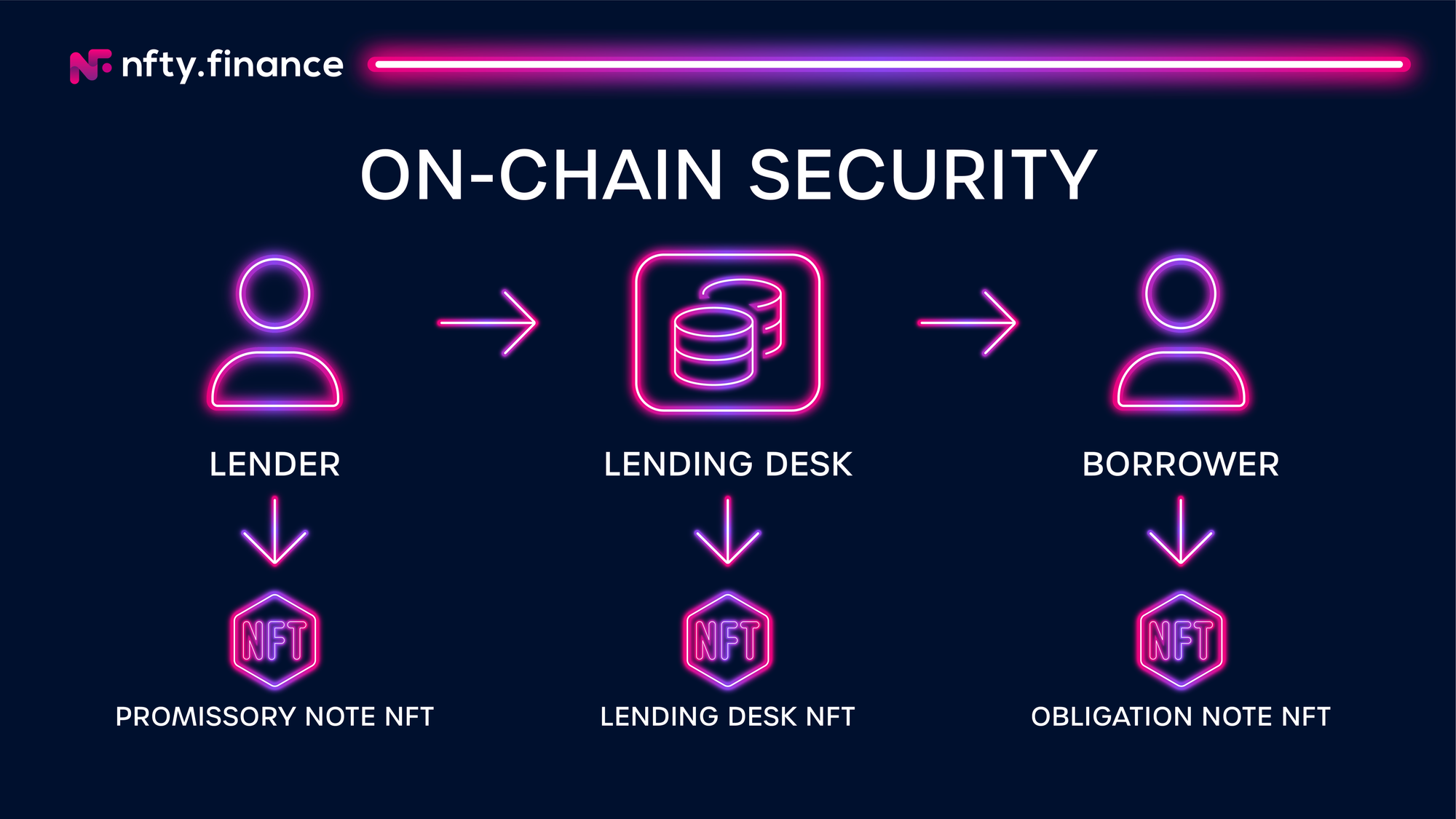

Secure and Transparent Lending Process

Every loan issued on NFTY Finance is secured on-chain, with the NFT serving as collateral locked inside a smart contract. Both the lender and the borrower receive NFTs – a promissory note NFT for the lender as a loan record, and an obligation note NFT for the borrower as a record of the loan. These NFT notes can be traded, swapped, borrowed, or lent against, similar to debt collateralized positions or interest rate swaps.

The Lending Desk itself is also represented by an NFT, which can be transferred, sold, or traded. Lending Desk parameters can be updated any time to adjust lending strategies, without affecting existing or active loans. This gives lenders the flexibility to manage their risk and reward effectively. In the event of loan defaults, the Lending Desk currently receives the NFT collateral.

Oracle-Free and Decentralized LAMM

Notably, NFTY Finance's LAMM model is oracle-free, i.e. it does not require price oracles. The lender sets and adjusts the loan bonding curve according to their risk tolerance and activity. This strategy creates a truly decentralized and innovative LAMM, a first of its kind in the NFT lending sector.

Looking Forward

While NFTY Finance currently supports individual lenders per Lending Desk, future plans include developing a more pooled automated market maker (AMM) system. This will allow smaller lenders to own a percentage of a Lending Desk. As of now, each lender is responsible for their risk and reward, allowing for an isolated and unmingled lending environment.

In addition, a Dutch auction system might be integrated in the future to allow lenders to retrieve their liquidity immediately from defaulted NFTs.

NFTY Finance is pushing the boundaries of NFT lending with its LAMM model, providing lenders and borrowers an automated, secure, and flexible platform for transacting in the NFT space. As the world of NFTs continues to evolve and grow, we're excited to see where NFTY Finance will lead the way.

NFTY Finance Testnet NOW LIVE 🔴

Stay in Touch

Website | Twitter | Discord | Testnet | Gitbook