Scaling Real World Assets with NFTY Finance

Decentralized finance (DeFi) has undergone a remarkable shift with the emergence of Real World Asset (RWA) technology. This novel approach involves digitizing and tokenizing physical assets on blockchains, enabling these assets to be represented by NFTs that can be traded, borrowed against, etc. In this article, we explore the significance of RWAs and how NFTY Finance, an innovative NFT-Fi platform, is set to expand RWAs through automated lending and borrowing.

RWAs – A Rising Trend

Real-World Asset Tokenization

The world of real-world asset tokenization ("RWAs") has been experiencing a surge in popularity, driven by growing user adoption and the entrance of major institutional players. This innovative approach of tokenizing physical assets on blockchain networks has captured the attention of the decentralized finance ("DeFi") space, particularly in light of relatively low DeFi yields and rising interest rates. Tokenized treasuries, in particular, have witnessed a significant uptake, with investors currently lending over US$600 million to the U.S. government through this market, yielding an impressive 4.2% annualized return.

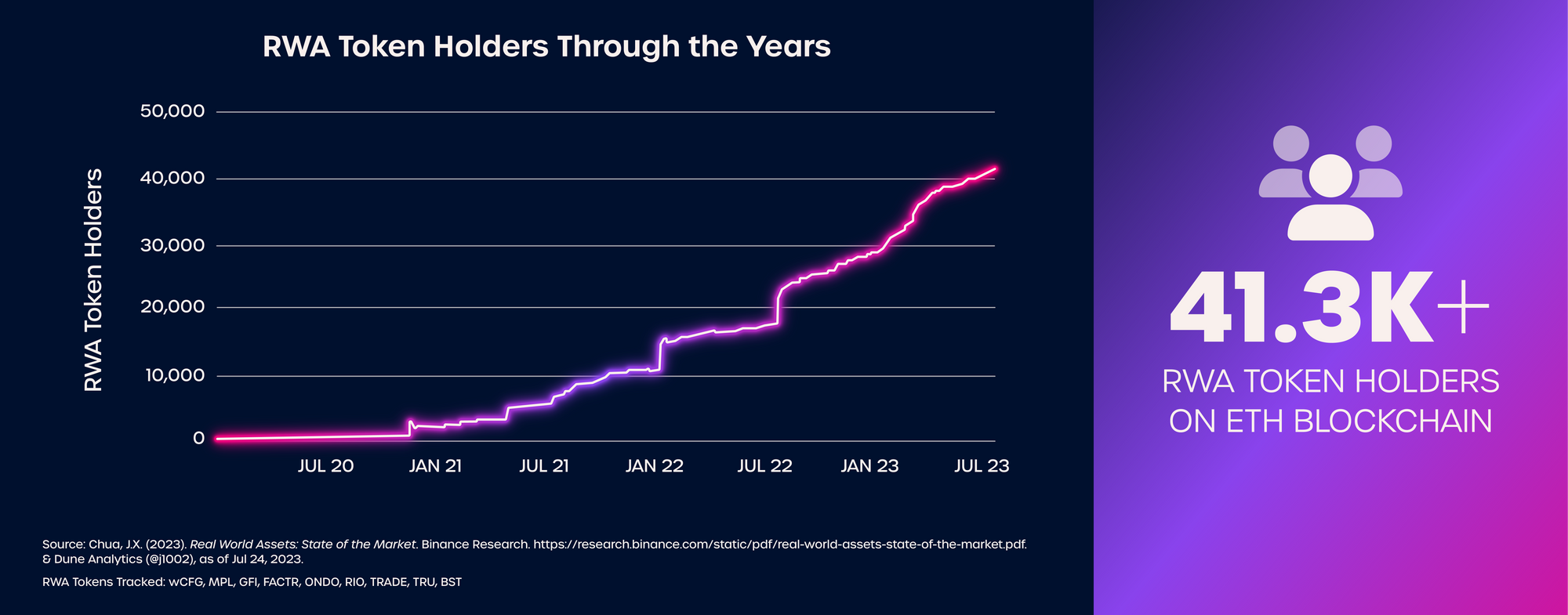

According to a research report by Binance, the tokenized asset market is projected to reach a staggering US$16 trillion by 2030. This anticipated growth signifies substantial headroom for the expansion of RWAs, representing a notable increase from its US$310 billion valuation in 2022. As the market for tokenized assets continues to evolve, an increasing number of protocols have integrated RWAs or actively participate in their growth.

Why Are RWAs Needed?

Traditional finance has often posed barriers to accessing real-world assets for the average investor. Many tangible assets, such as real estate, commodities, and agricultural lands, have been illiquid and limited in tradability. RWAs address this limitation by converting these assets into digital representations, allowing fractional ownership and global accessibility. Moreover, RWAs provide a level of transparency and trust through blockchain-based systems, appealing to a wider range of investors.

Examples of RWAs

RWA Technology is Unlocking a Diverse Array of Applications

1. Diamond Tokenization with Tiamonds

Tiamonds leverage the Ethereum blockchain and the ERC721 Non-Fungible Token standard to create digital representatives of single diamonds. These tokenized diamonds function as tradeable assets, enabling investors to participate in the diamond market without the need for physical ownership. Diamond tokenization enhances liquidity, transparency, and accessibility in the diamond industry.

With tokenization, it is now possible to invest in high-value assets like diamonds!

— Tiamonds (@Tiamonds) July 21, 2023

The future of ownership is being reshaped with Tiamonds: an asset-backed diamond NFT.

Own Tiamonds 👉https://t.co/NT7x4E8W7o pic.twitter.com/BZ24A7UsSo

2. Tokenized Bankruptcy Claims with Found's Smart Claims

Found's Smart Claims offer advantages over traditional centralized marketplaces for bankruptcy claims. By utilizing blockchain and DeFi technology, Smart Claims provide enhanced security and transparency through decentralized, tamper-proof ledgers. Tokenized bankruptcy claims also enjoy better liquidity and global accessibility through NFT marketplaces. Holders of Smart Claims can tap into NFT-Fi loan products using their tokenized claims as collateral, benefiting from faster loan processing times, lower interest rates, and reduced reliance on intermediaries.

1/◉ We are excited to announce Found Onchain (https://t.co/3fdYHzhMsf). Found is launching a marketplace for trading tokenized bankruptcy claims. There are no blockchain solutions to rescue millions of account holders trapped as involuntary creditors in crypto bankruptcies.

— Found (@foundxyz) February 28, 2023

3. Tokenized Agricultural Assets with LandX

LandX is a prime example of tokenizing agricultural assets, revolutionizing the agricultural sector by tackling environmental issues and promoting decentralization. By tokenizing farmland as perpetual vaults, LandX offers investors inflation-hedged returns backed by legal contracts secured on underlying farmland. These perpetual vaults are available as liquid digital assets (xToken NFTs), providing investors with uncorrelated, inflation-hedged diversification. Investors can now easily view any transaction along the supply chain thanks to LandX's token ecosystem, creating a level playing field with increased transparency and trust among all stakeholders, from farmers to validators and investors. Furthermore, LandX's innovative revenue model includes sustainability in perpetuity through LandX Choice grants, where part of platform fees generated on the protocol goes back into funding research and farming innovations to promote efficiency and sustainability in agricultural practices.

🐻 Bear or 🐂 bull.... it makes no difference to us.

— LandX (🌽,🌾) (@landxfinance) July 27, 2023

This is the ⚒️ builders'⚒️ market & LandX is popping up everywhere.

Taking it all in can be overwhelming, but don't worry - we're here to help.

Let's take a look at some of the best LandX 🧵's so far this summer.

👇 pic.twitter.com/tIb8hAri9Q

4. Tokenized Real Estate with Roofstock

Roofstock, a property technology company specializing in single-family rental homes, recently completed its second on-chain property sale through its Web3 subsidiary, Roofstock onChain (ROC). The property was sold for $180,000 on an NFT marketplace developed by Origin Protocol, marking the first home purchase with on-chain leverage from DeFi lender Teller protocol. Roofstock initially recognized blockchain's potential to enhance accessibility to single-family rental homes as it grew. The process of buying a property via the NFT marketplace involves creating an NFT associated with sole ownership of a limited liability company (LLC) holding the property title. Buyers and sellers must mint membership tokens through KYC checks to create NFTs, ensuring legal compliance. The ROC property NFTs adhere to the ERC-721 standard, and the ownership token's structure avoids classification as a security under the Howey four-prong test.

Want to buy a house? Look no further than NFT marketplaces.

— Blockworks (@Blockworks_) February 3, 2023

Latest from @_bessieliu https://t.co/5YOww5UxrU

5. Tokenized Physical Collectibles with Courtyard

Tokenization through Courtyard simplifies the intricate process of trading and safeguarding valuable physical collectibles, effectively addressing challenges related to shipping, fees, damage, and theft. With the introduction of "connected collectibles", these items undergo a transformative journey onto the blockchain, ushering in a realm of possibilities. This process entails a strategic partnership with Brinks, a renowned leader in authentication, insurance, and vaulting services. Additionally, the creation of precise 1:1 3D models for each asset facilitates minting, culminating in the emergence of secure and easily accessible connected collectibles. Courtyard, as a Y combinator startup, embraces its core mission of offering a secure and user-friendly avenue, empowering individuals of all backgrounds to seamlessly own and trade their physical collectibles as NFTs.

GM! Let's do a refresher on what https://t.co/jU3rDhJZa3 is, and why you should keep an eye out if you're a collector of anything physical 👀

— Courtyard.io (@Courtyard_NFT) February 14, 2023

tl;dr: we're a @ycombinator startup that built a secure and easy way for anyone to own/trade their physical items on the blockchain 🧵👇 pic.twitter.com/CMUq1j0cOl

How NFTY Finance Scales RWAs

Utilizing Automated Borrowing & Lending

The NFTY Finance protocol is uniquely positioned to help scale RWAs through automated borrowing and lending strategies. This innovative protocol bridges the gap between fungible and non-fungible tokens, unlocking the untapped potential within these assets. By facilitating lending of any ERC-20 token against any ERC-721 or ERC-1155 token, NFTY Finance addresses a significant market void in untapped ERC-20 and ERC721/1155 tokens without use cases estimated at $15 billion. Through NFTY Finance, holders of real world asset NFTs can participate in borrowing and lending activities, providing additional financial avenues and promoting liquidity.

NFTY Finance has the technology to support a wide array of RWAs:

🙅 No Oracles

NFTY Finance does not utilize on-chain oracles, enabling lenders and borrowers to valuate the market themselves. This approach is particularly crucial when dealing with assets lacking a well-defined price history or those that experience less frequent trading compared to more liquid assets.

⚡ Composable Base Layer

NFTY Finance serves as an ideal foundational layer for building complimentary tech on top of. The protocol's smart contracts have been designed in a manner that allows anyone to leverage the fundamental features of the protocol as a framework for borrowing and lending infrastructure.

🤝 Ownership of Lending Pools

When utilizing NFTY Finance, lenders can be confident that they control the liquidity they are allocating to borrowers. There are no shared pools. Lenders not only have full control of their "Lending Desks," but they can also transfer ownership of the lending desk to another wallet by simply transferring the "Lending Key," represented by an ERC-721 token. Lending Keys can be borrowed against, traded, sold, etc. The possibilities are in the lenders hands.

♻️ Tradable Borrow/Lend Positions

Lenders & borrowers on NFTY Finance can effortlessly swap, transfer, or borrow against their positions in an active loan. When a borrower requests a loan from a lending desk, two NFTs are minted to symbolize both the borrower's and lender's sides of the loan. The borrower's position is depicted as an "Obligation Note," while the lender's position is represented by a "Promissory Note."

💸 Lend with any ERC-20

Using NFTY Finance, lenders have the ability to deposit ANY ERC-20 token into their Lending Desks, offering loans against ANY ERC-721 or ERC-1155 asset. This expansive approach introduces a realm of opportunities that are currently unavailable to lenders or borrowers using existing NFT-Finance protocols.

🤑 Borrow Against any ERC-721/1155

NFTY Finance allows NFT holders to discover loan offers from various lending desks through the "Quick Loan Aggregator." As long as a lender has made a lending desk for the NFT collection borrowers want, liquidity will be available. This means that if an NFT-backed real-world asset (RWA) needs a simple way to get a loan, they can easily make a lending desk and put ANY ERC-20 token for ANY ERC-721 or ERC-1155 asset. No special permissions are needed, and there are no limits.

Thanks for Reading

The Future of RWA Technology

Real World Asset technology has ushered in a new era of decentralized finance, democratizing investment opportunities and transforming how we perceive and interact with real world assets. The growth of RWAs across industries, from real estate to bankruptcy claims, commodities, and physical collectibles has created a dynamic and robust financial ecosystem. As the NFT-Finance space continues to evolve, NFTY Finance stands tall as a trailblazer, enabling seamless scaling of RWAs through automated borrowing and lending. With NFTY Finance, the vision of an interconnected and accessible digital economy, powered by real-world assets, becomes a reality. As we embrace this future, the potential for further innovation and financial empowerment knows no bounds.